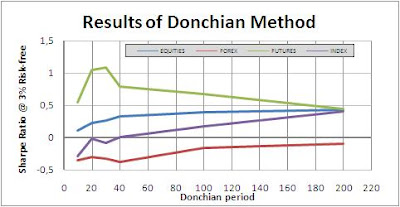

I'm also currently starting and testing a new trading model based on the Donchian 20/20 method, whose original rule states that one should BUY if the price of the asset is higher than the 20-day maximum price of the asset, and close this position if the price comes below the 20-day minimum price (as a stop-loss technique); the strategy states that the reverse should also happen ie. SHORT at the 20-day minimum and cover at the 20-day maximum.

What I have done is: I tested this exact strategy for a group of Equities, Indices, Commodities and Forex crosses.Here are the results:

Conclusion: good for Commodities, and even then my other models have Sharpe ratio's of around 4, which makes them a lot more efficient and hence more profitable.

Conclusion: good for Commodities, and even then my other models have Sharpe ratio's of around 4, which makes them a lot more efficient and hence more profitable.Let me know if you think other variations to these could yield better results perhaps (reducing the exit values to 20/10, 30/10 and so on don't improve the results that much, I've tested them already).

The data taken is for historical end of day data for the past 10 years (starting on the 1st January 1998).

Cheers!

Sem comentários:

Enviar um comentário